Definition of a fine wine

- In academic literature, there is no precise definition of a fine wine.

- Investable fine wines are restricted to the 25 best Bordeaux wines and a minority of wines from other regions (Australia, Burgundy, California, Italy, Portugal, Spain) (Milner, 2011).

- These wines can be sold in well-known auction houses.

- They have achieved a kind of 'blue chip' status.

- About 90% of Liv-ex turnover is from Bordeaux wines and more than half of it is concentrated on the five first growths.

- Fine wine is an investment with a potential return, as opposed to a non-fine wine that they name a “normal wine”1.

- See the literature review of the dynamics of the fine wine returns2.

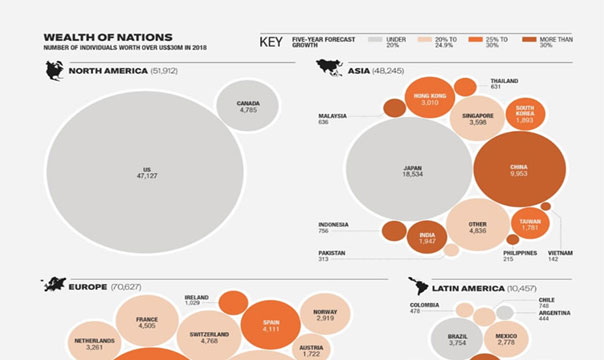

Importance of Asian and Chinese wealth

- According to Knight Frank's 2018 Annual Report on Global Wealth, wealth creation has been dominated by emerging economies, particularly Asia.

- The highest population net worth growth rates in 2017 were recorded by China (14%), India (9%) and Singapore (8%).

- In absolute terms, China experienced the second largest increase in the number of wealthy households, with an increase of nearly 46,000 households in one year, i.e. 373,000 wealthy households, almost as many as Germany (375,000).

- There are 207,350 households in China with more than US$5 million in 2017, a 96% increase between 2012 and 2017, compared to 56% in India, 43% in Hong Kong, 41% in Korea and 5% in Singapore.

- In Asia, there are 686,820 households with more than US$5 million in 2017, an increase of 39% between 2012 and 2017.

Figure 1.

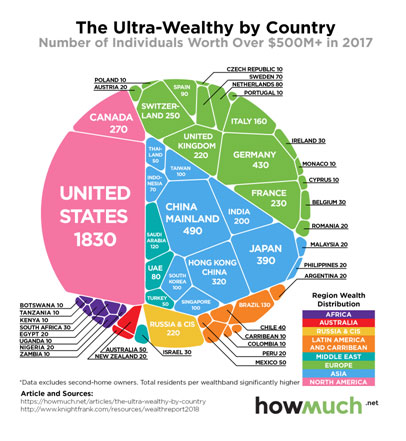

Figure 2.

Luxury investments

- This fast-growing affluent class has discovered luxury products and collectibles as a way to differentiate themselves and transmit their new status to the outside world.

- It favors prestigious objects such as jewelry, works of art, precious metals, classic cars and fine wines.

- The Chinese and Hong Kong wealthy households hold 17% and 14% of their total assets respectively in collectibles and luxury items3.

- The wine market is aimed at a wide range of customers and all their needs.

- It ranges from relatively cheap bulk wine for daily consumption, found in most supermarkets, to fine wine that is more expensive and rarer to find.

- Great fine wines are generally limited to the 25 best Bordeaux wines and a minority of wines from other regions or countries4.

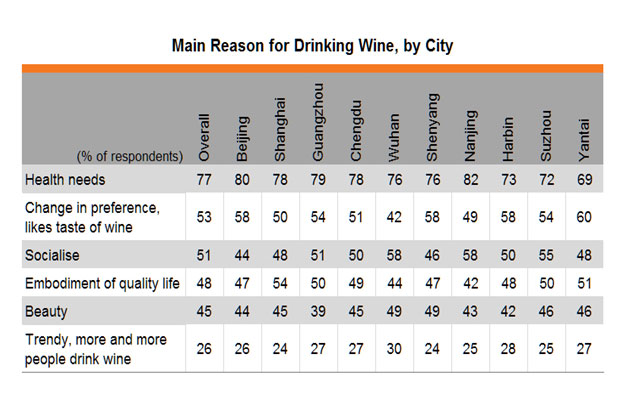

China’s Wine Market Consumer Preferences

- Several factors explain the increased interest in fine wines and the increase in their consumption in China.

- Increased economic and political openness has led the population to adopt Western lifestyle traits.

- At the same time, Chinese government policies have changed consumer behavior by promoting a healthier consumption of red wine than traditional rice wine.

- Finally, better education and higher incomes have led to the emergence of a new well-off and educated class that likes good wine5.

Figure 4.

Brief literature review?

- Only one paper on this topic.

- Masset, Weisskopf, Faye, Le Fur (Emerging Markets Review, 20166).

- Between 2008 and 2014, fine wines are on average sold at 19% more expensive at auctions in Hong Kong than in other major markets around the world.

- This premium is not uniform and is more pronounced for wines with perfect Parker scores and the most famous châteaux.

- However, the premium decreased throughout the estimation period indicating the increase in Chinese knowledge of fine wines.

- In addition, fine wine is an interesting alternative asset for wealthy Chinese as well as a popular consumer good (See Outreville and Le Fur (20207) for a literature review of the hedonic price functions and wine price determinants).

Database

- Auction sales in Hong Kong over the period April 2013-September 2017

- Acker Merall & Condit, Bonhams, Christie’s, Sotheby’s, Zachy’s Wine

- 5 First Growths: Haut-Brion, Lafite Rothschild, Latour, Margaux, Mouton Rothschild

- Bottle standard

- 6,832 sales and 84,808 bottles representing more than 50 million US dollars.

- 84% are sold in original wooden case that guarantee the authenticity of the bottles.

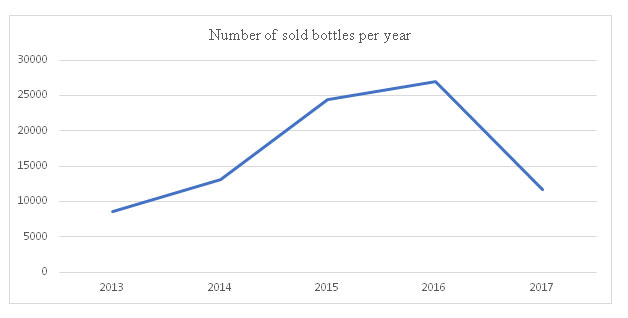

- We are looking to determine how the demand for Bordeaux fine wines in Hong Kong has evolved since the 2012 financial crisis.

- We only use vintages since 1945. Only standard bottles are retained representing sales, bottles and a total of more than US dollars.

- The most expensive bottle is a 1945 Mouton Rothschild sold at Sotheby's in January 2015 for $47,775.

Observations and average

- The average price over the entire study period was $734.

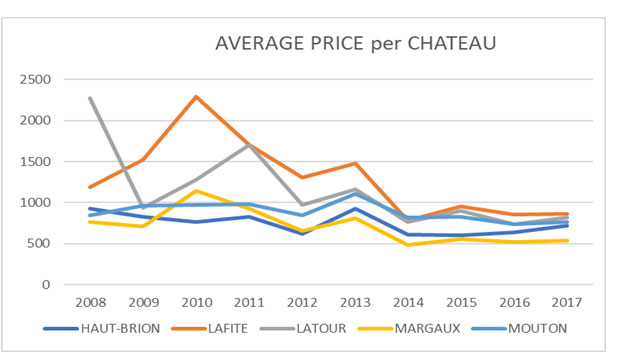

- The first graph compares the average annual prices of all sales and those of the first 5 First Growths.

- The second graph shows the number of sales made each year (2013 and 2017 being partial).

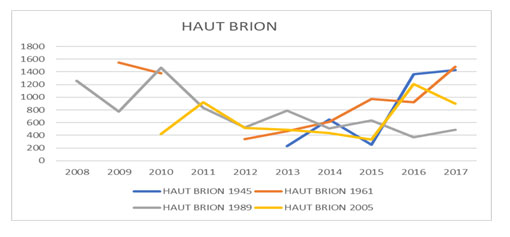

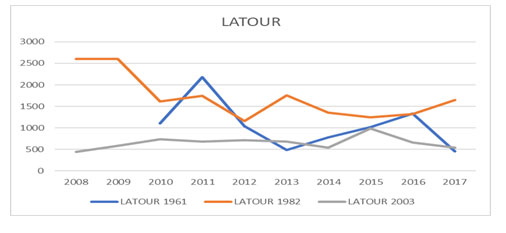

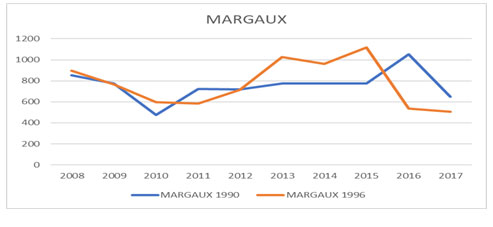

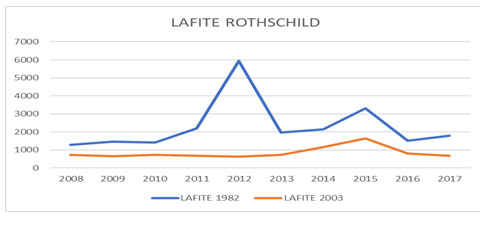

- The other graphs present prices by chateau as well as by vintage.

Figure 5.

Figure 6.

Figure 7.

Figure 8.

Figure 9.

Figure 10.

Figure 11.

Conclusions

- Sales and average prices of Bordeaux fine wines have declined in recent years, certainly to the benefit of other regions (Burgundy, Rhône, Italy, California, etc.) and/or other assets.

- However, with the exception of a few vintages, the prices of the wines with the highest ratings are generally stable over time.

- We can conclude that there is also a better knowledge of the fine wine market by Chinese investors